Guide to Gathering online casino that uses debit and Handling Security Deposits

Along with, explore sheets that are a similar size because the forms and you can times and you may suggest obviously the fresh line amount of the newest published setting that all the information applies. The brand new fiduciary is needed to offer a routine K-1 (541) to each recipient which get a distribution of possessions or an allocation of a bit of the brand new home. A punishment from $one hundred for each recipient (not to surpass $1,five hundred,100000 the calendar year) was implemented to your fiduciary when it needs is not came across. Anyone who try paid off to arrange an income tax return need to sign the new get back and complete the “Paid off Preparer’s Only use” the main get back.

- Additionally end up being beneficial to posting a change-away listing of all things that must be eliminated, as well as the prices per product in case your landlord needs to clean otherwise resolve the object instead.

- To have aim besides figuring your own taxation, you happen to be addressed as the a U.S. resident.

- Most identity deposit company wanted 30 days’s observe is actually a customers should withdraw money early.

- Numerous nonprofits and you may societal functions companies give advice about protection dumps or any other moving costs, such as the Salvation Military, Catholic Causes, and you will St. Vincent de Paul.

- Here’s a detailed overview of just what’s become assured, what’s currently happening, and when the newest recovery you are going to eventually reach those who work in you desire.

Online casino that uses debit – Fool around with Income tax Worksheet (Come across Recommendations Less than)

Team at the libraries and post organizations never give tax guidance or direction. Extremely blog post workplaces and libraries render online casino that uses debit free California tax booklets while in the the fresh processing season. The new numbers moved of Plan Grams, line F and line H, will be just were money and you may write-offs reportable to Ca. Ca cannot adhere to licensed home business inventory gain different under IRC Point 1202. Is all the money progress, even though distributed, which might be attributable to earnings underneath the ruling software or local legislation. Should your count to your Plan D (541), line 9, line (a) try a net losses, enter into -0-.

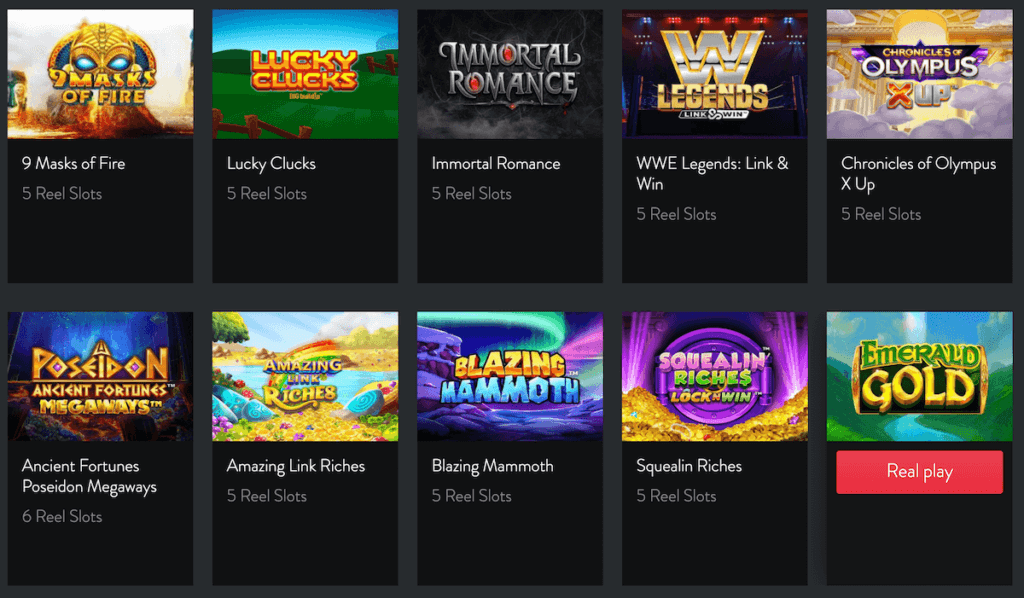

Online slots games

Really says restriction just how long you have got to communicate it suggestions. If you possibly could, offer your new emailing address for the property owner otherwise possessions management business As soon as possible. For individuals who wear’t features a new target, let them have a reliable address for example a great buddy’s or a family member’s address.

Paying rates of interest to your Defense Deposits

There’s a great $a dozen monthly provider payment that’s waived for those who have a great month-to-month lead put out of $500+ otherwise remain a minimum each day harmony of $1,500 or features $5,000+ in any mixture of being qualified Chase checking, offers, or other balances. To obtain the $three hundred, open an alternative membership, set up, and set up-and receive head dumps totaling $five-hundred or even more in this ninety days. Immediately after all the requirements try met, Bank of America will attempt to invest the bonus within this sixty months. Their $300 cash bonus was deposited in the account in this 60 times of appointment standards.

The newest nonexempt section of one scholarship otherwise fellowship offer that’s You.S. resource earnings try treated because the efficiently associated with a swap or company in america. For more information, find Services Did to have International Workplace within the section step three. The money are treated while the U.S. origin income if the a taxation out of less than ten% of one’s money from the sale try paid off in order to a foreign nation.

The information was not examined, approved otherwise endorsed because of the these organizations. One of is own favourite devices (here is my personal appreciate tits away from devices, everything i play with) is actually Empower Individual Dash, which allows your to deal with their cash in just 15-moments per month. However they render financial planning, for example a pension Considered Device which can inform you if the you’re on song in order to retire when you need. Inside the Computer system Science and you may Economics away from Carnegie Mellon University, an enthusiastic M.S. In the Information technology – Software Systems of Carnegie Mellon University, along with an experts operating Administration out of Johns Hopkins University.

Quite often, landlords usually do not fees for just what is known as typical “wear and tear.” Regular damage to have normal play with is usually to be asked, such as light carpet damage, diminishing paint, and you can aging appliances. For many who cause excessive damages such as gaps in the walls otherwise greatly discolored carpet, you are charged of these sort of damage.

The new cruising or deviation permit awarded under the requirements within this section is only to the specific departure in which it’s given. Aliens either in of those classes who have not submitted a keen tax come back or repaid taxation for the income tax year have to document the new return and spend the money for income tax prior to they will be awarded a cruising otherwise deviation allow on the Setting 2063. For those who inserted the united states while the a good nonresident alien, but are now a citizen alien, the brand new pact exclusion might still apply. Find Pupils, Apprentices, Trainees, Educators, Professors, and you can Scientists Just who Turned Resident Aliens, afterwards, lower than Citizen Aliens.

- Organization credits will be applied up against “net taxation” prior to almost every other loans.

- To learn more and ways to sign up for a certificate away from Visibility, go to SSA.gov/international/CoC_link.html.

- Thus, to possess tax ages beginning January 1, 2024, the aforementioned election will no longer be accessible for students and trainees of Hungary.

- Decline is an amount deducted to recover the purchase price or other basis from a trade otherwise organization resource.

Certain taxation treaties also provide conditions away from money (or quicker income tax costs) to prospects you to qualify for advantages within the taxation treaties. Earnings produced from the brand new separate assets of just one companion (and that isn’t attained earnings, trading or company income, or relationship distributive share earnings) are treated while the money of this mate. Make use of the appropriate neighborhood assets rules to see which are separate assets.

Put it to use only when the brand new lease ends or if you provides in order to evict anyone. Dealing with protection places smartly is paramount to a successful local rental company. It’s regarding the finding the best equilibrium ranging from securing your house and you may maintaining a confident tenant relationship.

Range step one – Attention money

To determine if you meet the ample visibility try to have 2024, number a full 120 times of visibility in the 2024, 40 days inside the 2023 (1/3 from 120), and 20 weeks within the 2022 (1/six from 120). While the overall to the step 3-seasons period are 180 weeks, you’re not sensed a resident underneath the generous presence test to have 2024. If you are an enthusiastic alien (not an excellent You.S. citizen), you’re experienced a good nonresident alien unless you fulfill certainly one of the two testing discussed under Citizen Aliens below.

Get or losses on the product sales or change away from personal property basically has its origin in the us when you have a tax house in the us. If you don’t have an income tax household regarding the United Says, the fresh gain or loss could be considered to be from supply away from Us. Revenues of source in the united states has development, earnings, and you can income in the sales and other temper from property located in the You. The above mentioned edge benefits, with the exception of income tax reimbursement and you will dangerous otherwise difficulty obligations shell out, are acquired centered on your own prominent work environment. Their prominent office is often the set the place you spend much of your functioning day. This could be your office, plant, store, shop, and other place.

The brand new U.S. tax go back you ought to document because the a twin-reputation alien hinges on whether you are a citizen alien otherwise a nonresident alien at the end of the new taxation 12 months. Income away from You.S. source is nonexempt whether you get it while you are an excellent nonresident alien or a resident alien unless of course especially excused beneath the Inner Revenue Code otherwise a tax pact supply. Fundamentally, income tax treaty provisions apply just to the fresh part of the seasons you had been a good nonresident. At times, but not, treaty conditions will get implement when you have been a resident alien.

An interest in a different corporation possessing U.S. real-estate may be maybe not a good You.S. real property attention unless of course this provider decides to getting handled while the a domestic corporation. For deals inside brings or securities, which applies to people nonresident alien, as well as a distributor otherwise representative inside the holds and you can ties. Earnings of any kind which is exempt from You.S. taxation under a good treaty to which the united states try a great group is excluded from your own revenues. Income about what the newest tax is only restricted to treaty, yet not, is included within the revenues. If you were repaid by the a different workplace, their U.S. resource income may be exempt out of You.S. tax, however, only if your see one of several points talked about 2nd. To help you be considered as the profile attention, the interest must be paid off to the debt granted after July 18, 1984, and you will if not susceptible to withholding.